The Indian rupee edged higher on Friday, supported by a weakening U.S. dollar amid expectations of upcoming Federal Reserve rate cuts. However, the domestic currency’s upward movement was restrained by steady dollar buying from foreign and state-run banks.

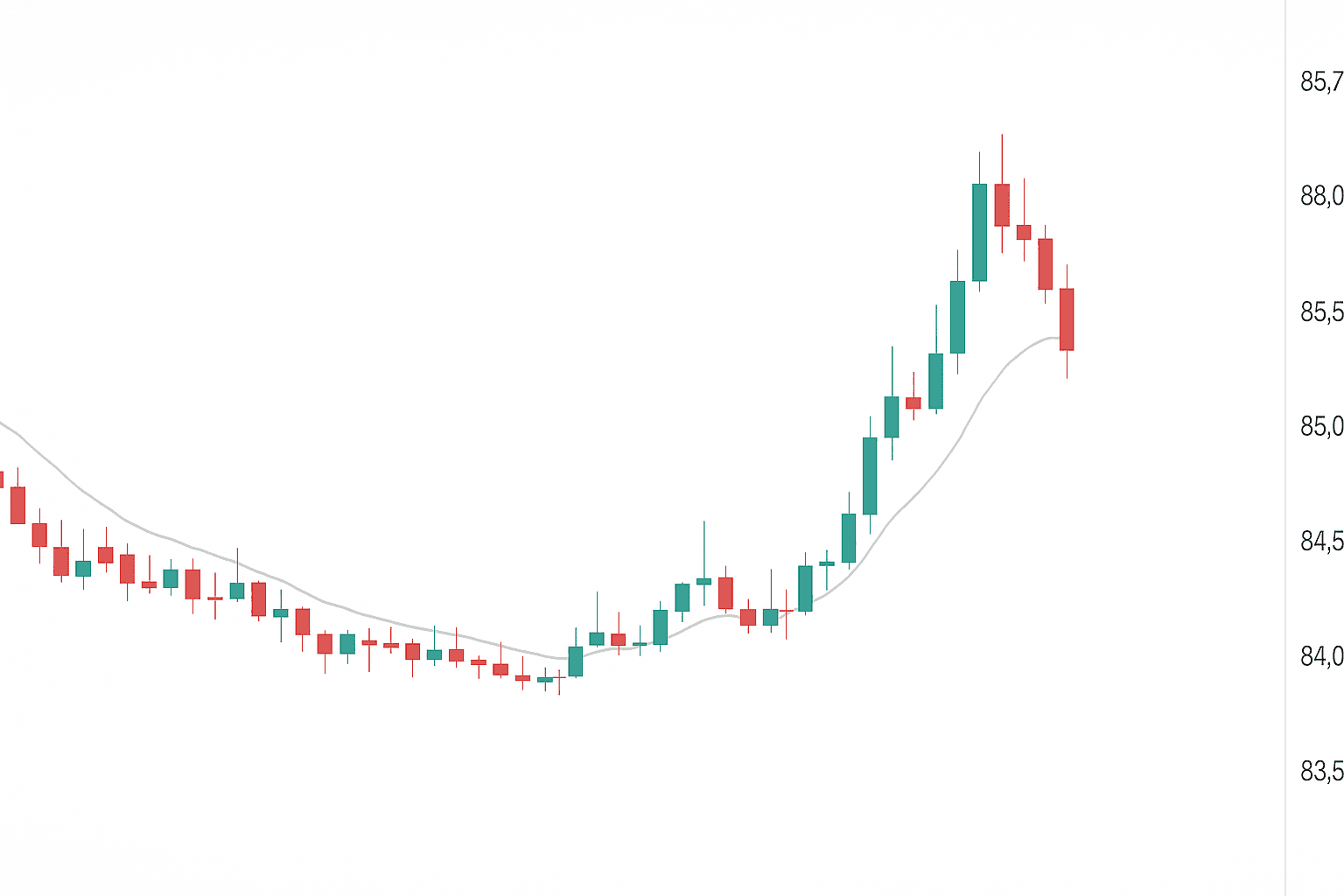

The rupee opened strong, breaching the 85.50 level in early trade, and was last seen at 85.5375 per U.S. dollar, a 0.2% gain on the day.

The U.S. dollar index stood at 97.4, hovering near a three-year low. While some Asian currencies traded mixed, Indian equity indices—the BSE Sensex and Nifty 50—also posted modest gains.

Market sentiment remains influenced by speculation that U.S. President Donald Trump might soon announce a more dovish Federal Reserve chair. Expectations of monetary easing have weighed heavily on the dollar, which is already under pressure due to ongoing concerns over trade and fiscal policies in the U.S.

Year-to-date, the dollar index has declined over 10%, on course for its steepest first-half drop since the early 1970s, when floating exchange rates were introduced.

BofA Global Research maintains a bearish long-term outlook for the dollar, citing U.S. economic uncertainty, the anticipation of Fed rate cuts, and increasing FX hedging by global institutional investors.

Meanwhile, the overnight dollar-rupee swap rate inched up slightly, with market participants pointing to sell/buy swaps from foreign banks. These moves are likely linked to dollar inflows from a significant domestic IPO—HDB Financial’s $1.5 billion offering, which had been nearly twice subscribed by late morning Friday.