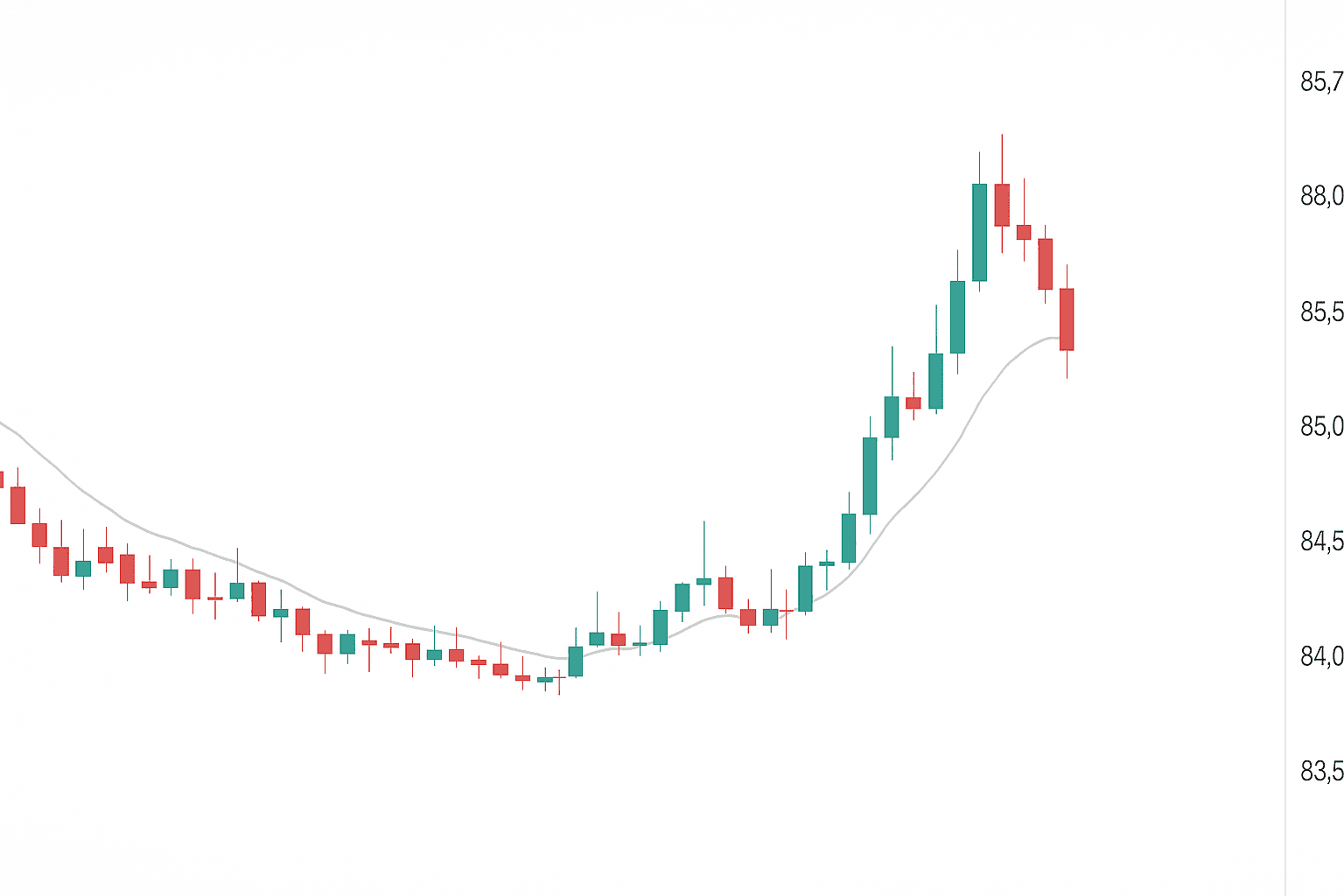

Indian equity markets opened the first trading session of FY26 on a weak note, extending losses as investors turned cautious ahead of U.S. President Donald Trump’s reciprocal tariff announcement.

At 10:32 AM, the Sensex dropped 972.03 points (1.26%) to 76,442.89, while the Nifty 50 fell 227.35 points (0.97%) to 23,292.00. Market breadth remained mixed, with 2,321 stocks advancing, 972 declining, and 125 remaining unchanged.

Sectoral Performance & Market Trends

The broader markets fared slightly better, with the Nifty Midcap 100 and Nifty Smallcap 100 slipping around 0.5% each. However, sectoral indices reflected heightened investor caution:

- Nifty IT index declined 1.5%, reacting to global uncertainties.

- Realty stocks fell 1%, following Maharashtra’s decision to increase Ready Reckoner Rates, making property purchases costlier.

- Nifty Auto and Nifty Media indices gained 1% each, bucking the overall market trend.

Investor Sentiment & FII-DII Activity

The recent market volatility stems from concerns over Trump’s tariff policies, leading to heavy selling pressure in IT, auto, and pharmaceutical stocks.

- Foreign Institutional Investors (FIIs) turned net sellers on March 28, offloading ₹4,352 crore worth of equities.

- Domestic Institutional Investors (DIIs), however, remained bullish, purchasing stocks worth ₹7,646 crore.

“India’s markets saw a 6.3% return in March, outperforming most global indices. The upcoming tariff decision will be crucial—if the tariffs are less severe than expected, markets may rally, led by IT and pharma stocks. However, if they are stringent, another downturn is likely,” said VK Vijayakumar, Chief Investment Strategist at Geojit Investments.

Global Cues & Trump’s Tariff Policy

Last week, Trump imposed a 25% tariff on automobile imports, raising concerns about price hikes in the sector. The eagerly awaited reciprocal tariff announcement on April 2 has kept investors on edge.

Overnight, Wall Street ended mixed:

- S&P 500 and Dow Jones gained, while

- Nasdaq Composite dipped 0.14%.

For Q1 2025 (January-March), both S&P 500 and Nasdaq posted their worst quarterly performances since 2022, driven by economic policy uncertainty in the U.S.

Stock Highlights: Vodafone Idea, HAL Surge

- Vodafone Idea (VI) shares jumped 10% after the Central Government announced it would convert outstanding spectrum dues into equity.

- Hindustan Aeronautics Ltd. (HAL) surged 6%, following new ₹62,700 crore contracts from the Defence Ministry. International brokerage UBS raised HAL’s target price to ₹5,440 per share.

With global uncertainties and Trump’s tariff decision looming, investors remain cautious, awaiting further clarity on trade policies before making major market moves.