MUMBAI, June 30 (Reuters) – The Indian rupee is poised to strengthen further at Monday’s market open, supported by a broader rally in Asian currencies following encouraging trade signals between the U.S. and China.

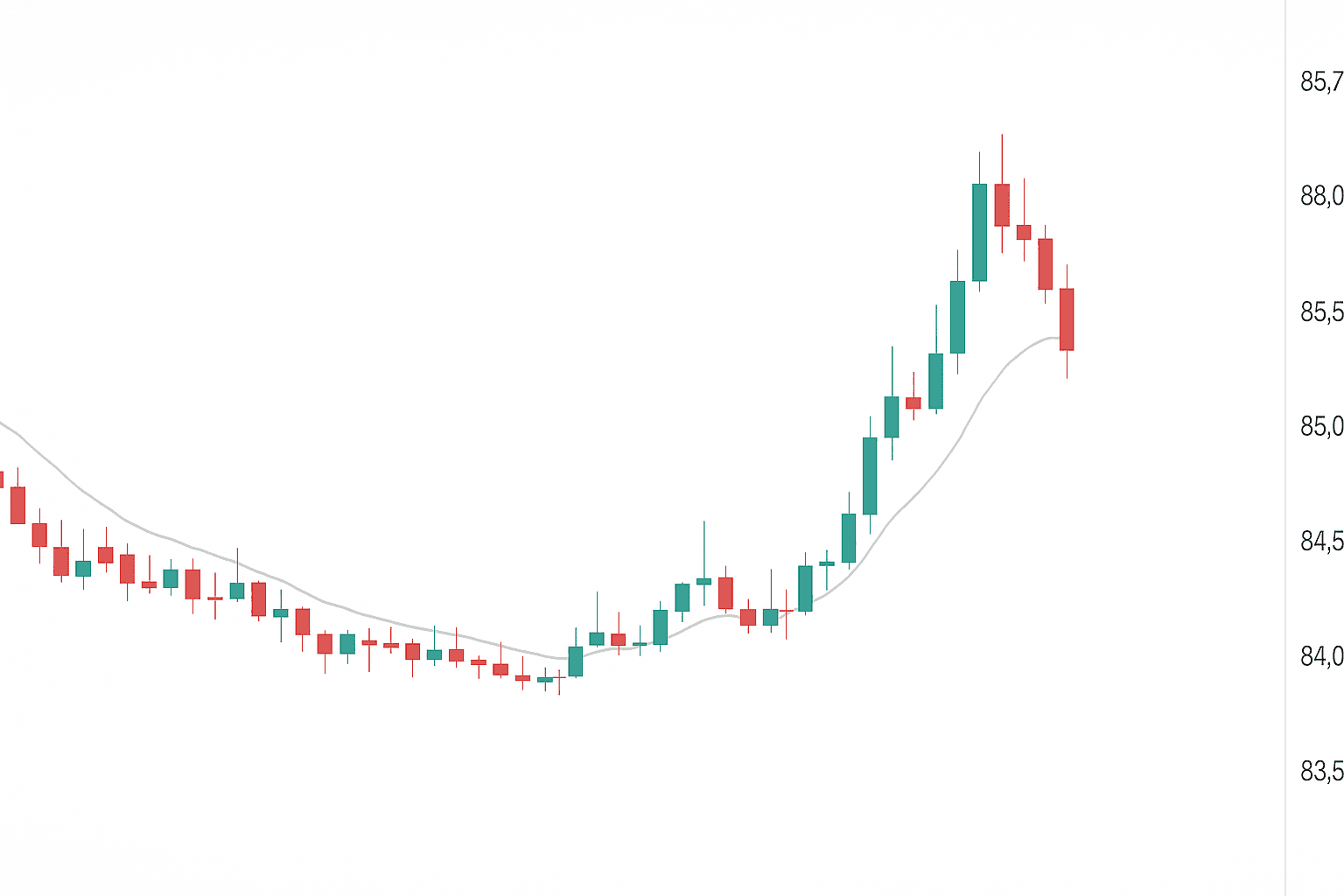

According to the one-month non-deliverable forward market, the rupee—already up 1.3% last week to 85.4750 against the dollar—is likely to open marginally higher. The previous week’s performance was the rupee’s best in over two years, driven by falling oil prices and persistent U.S. dollar weakness.

A Mumbai-based currency trader noted that the rupee now shows an upward bias, especially after a clear move below the 85.80 mark. “There’s likely to be strong dollar supply at higher levels,” he said, placing key support for the USD/INR pair at 85.30 and then at 85.00.

Asian currencies also reflected strong sentiment: the offshore Chinese yuan rose to 7.16 per dollar, close to its highest point this year, while the South Korean won led the rally with a 0.5% gain.

Investor confidence was further boosted by news that the U.S. and China had agreed to fast-track rare earth approval processes—a deal confirmed by both sides. This follows a broader agreement reached earlier in June, signaling improving diplomatic and trade relations.

Adding to the rupee’s tailwinds, Friday’s U.S. economic data revealed weaker-than-expected consumer spending. This has strengthened the case for Federal Reserve rate cuts, prompting market participants to price in up to 75 basis points of rate reductions in 2025, beginning as early as September.

Key Market Indicators:

- One-month NDF rupee rate: 85.55

- Onshore forward premium: 10.5 paise

- Dollar index: Down at 97.18

- Brent crude: Down 0.3% at $67.6/barrel

- U.S. 10-year Treasury yield: 4.28%

- Foreign investments (June 26):

- Equities: Net $1,243.5 million inflow

- Bonds: Net $71.7 million inflow

With global sentiment tilting toward easing monetary policy and improving geopolitical ties, the Indian rupee appears to be riding a wave of optimism that could continue into the coming weeks.